Samsung wins highest number of smartphone shipments in Q1 2024 as market expands

What do you want to know According to a report by Counterpoint Research, the global smartphone market grew by 6% in the first quarter of 2024 year-on-year. Apple had an interesting quarter, posting a 13% decline in Q1 2024 year-over-year, despite recording its highest average selling price (ASP) on record. Samsung was the clear winner […]

What do you want to know

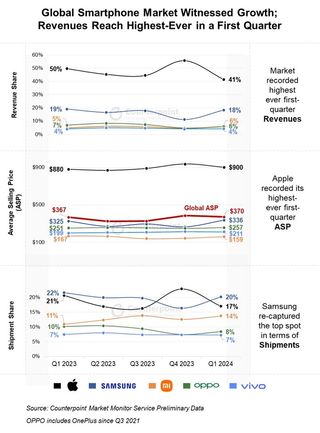

- According to a report by Counterpoint Research, the global smartphone market grew by 6% in the first quarter of 2024 year-on-year.

- Apple had an interesting quarter, posting a 13% decline in Q1 2024 year-over-year, despite recording its highest average selling price (ASP) on record.

- Samsung was the clear winner this quarter, regaining its place as the world’s top smartphone shipper.

The global smartphone market appears to be rebounding, with Android phones particularly successful in the first quarter of 2024, according to a report from Search for counterpoint.

Overall, the market grew 6% year over year, even though Apple shipped far fewer iPhones last quarter than in the first quarter of 2023. That’s partly due to the phones’ success Samsung Galaxy. A strong launch of the company’s Galaxy A-series smartphones appears to have propelled Samsung over Apple as the global shipping leader.

Samsung is usually the top smartphone maker in terms of total shipments, but it lost that title to Apple in the fourth quarter of 2023. However, as Apple saw a 13% drop in shipments from a year over year in the first quarter of 2024, Samsung was able to regain first place. Samsung devices accounted for 20% of total smartphones shipped last quarter, while iPhones dropped to 17%.

As has been the case over the past few quarters, the high-end smartphone market continues to grow. According to Counterpoint, the market segment, including phones priced above $800, saw the fastest growth in the first quarter of 2024. Apple largely benefited from this trend in the last quarter as it has the selling price highest average (ASP) of any OEM, at $900. This is likely because buyers are choosing the more expensive iPhone 15 Pro and 15 Pro Max over the base models.

Additionally, Apple maintained its position as the smartphone revenue leader with a 43% market share. However, this figure is down 11% year over year, for several reasons.

“Tough competition in China, record upgrades in the US and a tough year-over-year comparison due to the iPhone 14 Pro offering moving to Q1 2023 all weighed on performance of the iPhone,” says Jeff Fieldhack, Counterpoint’s research director. “An improved product lineup, with 15 Pro models performing better than its predecessors, and a growing presence in emerging markets have helped Apple stem some of the declines.”

The overall growth can be partially attributed to the success of certain brands in regions outside of North America, including TECNO, Xiaomi, Honor and Huawei. Among the top five OEMs, Xiaomi saw the strongest growth last quarter, improving its shipments by 34% year-over-year.

Looking ahead, Counterpoint analysts expect the high-end smartphone market to continue growing. This is due to the expected release of new phones with generative AI features. Counterpoint predicts that 11% of smartphones shipped will feature generative AI this year. If Apple ends up including gen-AI features on the next iPhone series, joining Google and Samsung, this will likely be the case.